Weekly Market Commentary

By Category

Weekly Market Commentary

Apr 03, 2023Weekly Market Commentary

April 03, 2023

The Markets

Perhaps we should call this a pushmi-pullyu market.

The first quarter of 2023 brought Dr. Dolittle’s pushmi-pullyu – the rarest animal of all – to mind. It is the offspring of goat-antelopes and unicorns, and has a head at each end of its body. The pushmi-pullyu’s unusual anatomy allows it to easily and rapidly change direction, making it difficult to catch.

So far this year, the direction of the economy and financial markets has been elusive, too.

Is inflation headed in the right direction? Inflation changed course late in 2022. The monthly change in the rate of inflation, as measured by the PCE Core Price Index (one of the Federal Reserve’s preferred inflation gauges) accelerated late in 2022 and continued to move higher in January 2023. Then, it slowed in February, creating uncertainty about the state of inflation.

The latest University of Michigan Consumer Sentiment Survey indicated that Americans expect inflation to fall over the coming year and over the longer term. That’s important because there is a psychological aspect to inflation. When people expect inflation to rise, they spend more, which can push inflation higher.

If inflation is trending lower, then it gives weight to the opinion of investors who are optimistic the Fed will reverse course this year.

Will rate hikes continue or pause? Amid persistent inflation, the Federal Reserve delivered the message that rates might go higher than expected and stay there longer than expected. Then three banks failed, and speculation that the Fed would slow the pace of rate increases began. “The challenge for the Fed is figuring out how to buttress banks and cool inflation at the same time, without triggering a recession,” reported Megan Cassella of Barron’s.

The Fed raised rates in March, despite turmoil in the banking sector. Treasury yields fell across much of the yield curve following the rate hike. Yields moved higher last week, which suggests that bond investors may anticipate further rate hikes.

While many investors appear to be optimistic that the Fed will take a breather on rate hikes, Fed projections suggest it will continue to raise rates in 2023, although it may ease in 2024.

Are we headed for a recession? It’s a question that economists and analysts have been trying to answer for more than a year as central banks in the U.S., Europe, and elsewhere raised rates aggressively. Last week, Bloomberg’s survey of economists found the probability of a recession over the next 12 months was 65 percent, up from 60 percent in February.

“After the Fed last week raised rates a quarter percentage point to the highest since 2007, economists worry not only about the impact on demand but the effect on the banking system…Financial institutions risk becoming more guarded in their lending approach, restricting access to capital needed by businesses to expand and consumers to buy homes, cars and other big-ticket items,” reported Augusta Saraiva and Kyungjin Yoo of Bloomberg.

While the odds of recession crept higher last week, not everyone agrees that a recession is ahead.

Is the economy weakening or strengthening? We’ve seen strong jobs growth, yet the unemployment rate has risen as labor force participation increased. In addition, business activity was up sharply in March 2023.

“U.S. companies signaled a renewed expansion in business activity in March…Output grew at a solid pace that was the fastest since May 2022 as demand conditions improved and new order growth returned. Manufacturers and service providers alike registered upturns in output, with service sector firms driving the increase,” reported the S&P Global Flash US Composite PMI™ report.

The economic tea leaves have not provided a definitive answer about the strength and direction of the economy.

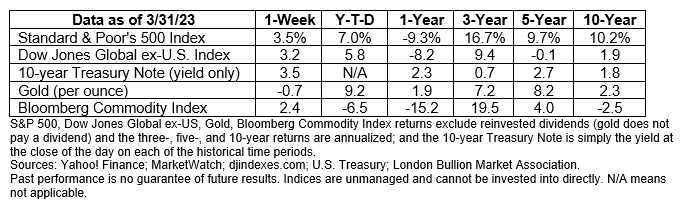

Despite all of the uncertainty, stock investors were optimistic last week, and major U.S. stock indices rose, reported Nicholas Jasinski of Barron’s. The Treasury market headed in the other direction as rates across most maturities of Treasuries rose and bond prices fell.

In a pushmi-pullyu market, it’s important to stay focused on your long-term financial goals. Basic principles of investing such as asset allocation, diversification and portfolio rebalancing remain sound. If you are feeling unsettled by market volatility, get in touch. We can review your goals and allocations to make sure they’re aligned.

IF YOU’RE WONDERING ABOUT TAXES AND RETIREMENT… Tax Day is almost here – it’s April 18 this year. If you’re retired or planning for retirement, it’s important to know that some states are more tax-friendly for retirees than others. Typically, in tax-friendly states, Social Security benefits are exempt from state tax and pension payments and/or IRA withdrawals may receive more favorable state tax treatment, reported David Muhlbaum and Rocky Mengle of Kiplinger.

“Our results are based on the estimated state and local tax burden in each state for two hypothetical retired couples with a mixture of income from wages, Social Security, traditional IRAs, Roth IRAs, private pensions, 401(k) plans, interest, dividends, and capital gains. One couple had $50,000 in total income and a $250,000 home, while the other had $100,000 in income and a $350,000 home.”

The most tax-friendly states were:

- Delaware

- Hawaii

- Colorado

- Wyoming

- Nevada

The least tax-friendly were:

- New Jersey

- Illinois

- Kansas

- Vermont

- Connecticut

When you’re deciding where to settle in retirement, there’s a lot more to consider than taxes. Family, friends, cost of living and weather also are key considerations. Weather is becoming more important as the number and intensity of natural disasters has been increasing, raising the cost of insurance significantly in some places, reported Kate Dore of CNBC.

Weekly Focus – Think About It

“Il n’est pas certain que tout soit incertain.” (It is not certain that everything is uncertain.)

—Blaise Pascal, mathematician and philosopher

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bea.gov/news/2023/personal-income-and-outlays-february-2023

https://www.investopedia.com/terms/i/inflationarypsychology.asp

https://www.barrons.com/articles/fed-rates-inflation-bank-crisis-recession-4533213c?mod=Searchresults (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/04-03-23_Barrons_The%20Feds%20Job%20Just%20Got%20a%20Whole%20Lot%20More%20Complicated_6.pdf)

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf (Figure 2)

https://www.bloomberg.com/news/articles/2023-03-28/economists-boost-us-recession-odds-on-higher-rates-banking-woes (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/04-03-23_Bloomberg_Economists%20Boost%20US%20Recession%20Odds%20on%20Higher%20Rates%20and%20Banking%20Woes_9.pdf)

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.pmi.spglobal.com/Public/Home/PressRelease/53e9f887b83e47d7bc6681c608d5aa3f

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-banks-fed-55ec13cd?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/04-03-23_Barrons_The%20Stock%20Market%20Rallied%20Into%20a%20Banking%20Slowdown_12.pdf)

https://www.kiplinger.com/retirement/601814/most-tax-friendly-states-for-retirees

https://www.kiplinger.com/retirement/601815/least-tax-friendly-states-for-retirees

https://www.cnbc.com/2022/08/07/climate-change-is-making-some-homes-too-costly-to-insure.html