Weekly Market Commentary

By Category

Weekly Market Commentary

Jan 08, 2024Weekly Market Commentary

January 08, 2024

The Markets

And we’re off…to a slow start.

Last week, investors appeared to suffer from a New Year’s hangover. The culprit was too much optimism.

After its December meeting, with inflation easing and the U.S. economy remaining resilient, the United States Federal Reserve (Fed) indicated that three rate cuts were possible in 2024. Assuming the Fed drops rates by 0.25 percentage points each time, the effective federal funds rate would fall by 0.75 percentage points to about 4.5 percent by the end of this year.

That was welcome news. Lower rates make borrowing less expensive for businesses and consumers. As a result, rate cuts could lead to lower interest rates on home and auto loans, as well as credit cards. In addition, lower rates could boost corporate profits and push stock prices higher.

Ebullient investors saw the inch and took a mile, extrapolating the possibility of three Fed rate cuts in 2024 to six rate cuts. Jeff Cox of CNBC explained. “Markets…followed up the meeting and Chair Jerome Powell’s press conference by pricing in an even more aggressive rate-cut path, anticipating 1.5 percentage points in reductions next year, double the [Fed’s] indicated pace.”

Investors’ buoyant outlook supported strong third-quarter performance and double-digit returns for major U.S. stock indices in 2023. However, investors recognized they may have taken things too far, and the U.S. stock market retreated for much of last week.

Friday’s employment report didn’t help matters. It confirmed the continued strength of the U.S. economy. Employers added 216,000 jobs in December, surpassing economists’ estimates, according to Megan Leonhardt of Barron’s. The unemployment rate remained at 3.7 percent and average hourly earnings were up 4.1 percent over the 12 months through December 2023.

The strong report lowered expectations that the Fed will cut the federal fund rate at its March meeting, reported Karishma Vanjani of Barron’s.

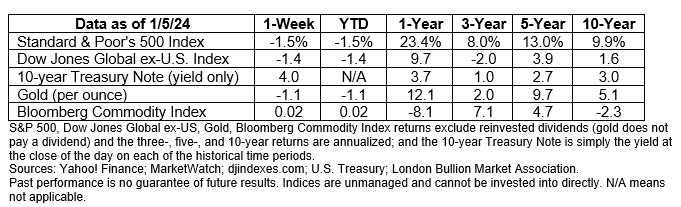

Last week, major U.S. stock indices finished the week lower, and the yield on the benchmark 10-year U.S. Treasury note rose.

THE POWER OF STORIES. Nobel-prize-winning economist Robert Shiller and his colleagues researched what they call “Narrative Economics” and found that popular stories affect our decision-making. In 2023, we witnessed the phenomenon firsthand as the story of the “Magnificent Seven” gathered steam.

For movie buffs (and people of a certain age), the name brings to mind the star-studded 1960s film with a reputation as one of the greatest Westerns of all time. The seven gunmen of the film are the reason pundits adopted the moniker to describe seven technology-related stocks that delivered double-digit returns in 2023.

“Shares of the so-called Magnificent Seven…individually soared between around 50% and 240% in 2023, making them among the market’s most rewarding bets… Because of their heavy weightings in the S&P 500…the seven were responsible for nearly two-thirds of the benchmark index’s 24% gain this year,” reported Lewis Krauskopf of Reuters.

If the goal of investing is to buy low and sell high, investors would have been better off investing in the Magnificent Seven in 2022 when they delivered a less-than-magnificent performance. Combined, they lost 39 percent that year, according to Joseph Adinolfi of Morningstar, and all seven finished 2022 with double-digit losses.

When the narrative focuses on a broader time horizon and individual share price performance, the story looks quite different. Three of the Magnificent Seven stocks have a negative average annual return over the last two years, three have a positive return, and one delivered a flat performance, reported Matt Krantz of Investor’s Business Daily.

The Magnificent Seven narrative offered investors an invigorating story. When reading stories about stocks or other investments that are performing well, it’s tempting to jump on the bandwagon. If an investment narrative captures your interest, give us a call. We can discuss the pros and cons of the opportunity.

Weekly Focus – Think About It

“Some narratives go viral because they contain real truth and knowledge and are useful. I’m more concerned with the other kinds of narratives that are story-quality, interesting, stimulating, fun—and travel person to person. They have a high contagion rate. Changes in public thinking are revealed by them and changes in public thinking are important causes of major economic events.”

—Robert Shiller, economist

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20231213.pdf

https://www.investopedia.com/investing/how-interest-rates-affect-stock-market

https://www.cnbc.com/2023/12/13/fed-interest-rate-decision-december-2023.html

https://www.cnbc.com/2024/01/04/stock-market-today-live-updates.html

https://www.barrons.com/articles/december-jobs-report-today-64efdb87?mod=hp_LEAD_2 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/01-08-24_Barrons_%20Decembers%20Strong%20Jobs%20Data%20Will%20Keep%20the%20Fed%20on%20Hold_5.pdf)

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.barrons.com/livecoverage/stock-market-today-010524/card/odds-of-march-rate-cut-dip-after-jobs-data-sgv1HdFF6ZBIT1fFuzWV# (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/01-08-24_Barrons_Odds%20of%20March%20Rate%20Cut%20Dip%20After%20Jobs%20Data_7.pdf)

https://www.barrons.com/livecoverage/stock-market-today-010524?mod=lc_navigation (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/01-08-23_Barrons_Latest%20Updates_8.pdf)

https://insights.som.yale.edu/insights/narrative-economics-how-stories-go-viral

https://www.bloomberg.com/news/articles/2023-12-27/magnificent-seven-stocks-risk-losing-sheen-in-fed-s-soft-landing?embedded-checkout=true (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/01-08-24_Bloomberg_Magnificent%20Seven%20Loses%20Importance_11.pdf)

https://www.morningstar.com/news/marketwatch/20231202479/the-magnificent-seven-have-dominated-the-stock-market-this-year-thats-the-bad-news https://www.investors.com/etfs-and-funds/sectors/sp500-three-of-the-magnificent-seven-are-actually-devastating-losers/