March 21, 2022

By Category

March 21, 2022

Mar 22, 2022The Markets

Markets were reassured by the Federal Open Market Committee (FOMC)’s actions last week.

The FOMC met on March 16 and did exactly what most people expected them to do. They raised the federal funds target rate by a quarter point. Federal Reserve Chair Jerome Powell said the Fed expects to continue to raise rates and reduce its balance sheet during 2022 to lower inflation.

The bond market appeared to give the Fed a vote of confidence. The yield on the two-year UST, which is the maturity that’s most sensitive to expectations for future rate hikes, rose from 1.75 percent at the end of last week to 1.97 percent. The yield on the benchmark 10-year UST also increased, but not by as much.

Randall Forsyth of Barron’s reported, “…moves in the Treasury market add up to a marked flattening in the slope of the yield curve, a classic signal the market foresees a slowing of real growth along with an eventual diminution of inflation pressures.”

In an ideal circumstance, the Fed would engineer a “soft landing” by pushing demand for goods down just enough to quash inflation without causing the U.S. economy going into recession. However, the Putin effect is making the Fed’s job harder. Fed Chair Powell stated:

“…the implications of Russia’s invasion of Ukraine for the U.S. economy are highly uncertain. In addition to the direct effects from higher global oil and commodity prices, the invasion and related events may restrain economic activity abroad and further disrupt supply chains, which would create spillovers to the U.S. economy through trade and other channels. The volatility in financial markets, particularly if sustained, could also act to tighten credit conditions and affect the real economy…We will need to be nimble in responding to incoming data and the evolving outlook.”

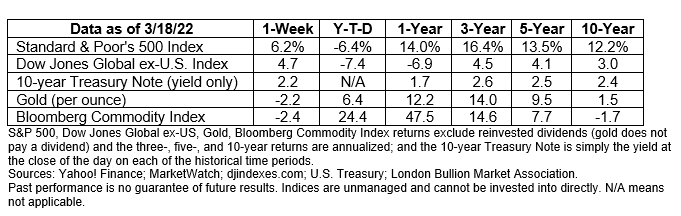

Improved clarity around monetary policy reassured investors last week. Major U.S. stock indices rallied with the Standard & Poor’s 500 Index gaining 6.2 percent, the Dow Jones Industrial Average rising 5.5 percent, and the Nasdaq Composite up 8.2 percent, reported Ben Levisohn of Barron’s.

SPRING FORWARD. FALL BACK. If you live in a state with daylight savings time, this may be the mnemonic device you use to remember that clocks gain an hour in March and lose an hour in November.

The idea of daylight savings time was touted by Ben Franklin, but it didn’t really catch on until World War I, reported The Economist. At that time, Britain, France and Germany decided that adding an extra hour of daylight would reduce coal usage and help the war effort, so they moved clocks forward for several months.

Changing time isn’t popular today. A survey taken in the U.S. last November found that, overall, about six in 10 Americans would prefer not to have a time change, reported Kathy Frankovic of YouGovAmerica.

Last week, the U.S. Senate unanimously passed the Sunshine Protection Act, a bill that would make daylight savings time the new permanent “standard time”. If the House of Representatives agrees the U.S. will have later sunsets all year round, beginning in 2023.

There may be economic advantages to adopting daylight savings time. Economists say that restaurants, retail stores and leisure businesses benefit from longer days, reported Angel Adegbesan of Bloomberg. There could be some disadvantages, too. Randyn Charles Bartholomew of Scientific American explained:

“Our wakefulness is governed by a circadian rhythm inside us linked to the solar cycle. Although many sleep researchers approve of ending the clock changes, they prefer the use of standard time… Less sunlight in the morning makes it harder for us humans to get started in the day, and more sunlight in the evening makes it harder to get to sleep. Darkness is a signal…that it’s time to start producing more melatonin, which is our body’s cue to lower internal temperature and start feeling sleepy. Early morning light…cause our bodies to stop melatonin production so we can feel wakeful throughout the day.”

That may be why making daylight savings time permanent was so unpopular the last time Congress did it, in the 1970s. The law was repealed after 16 months.

Weekly Focus – Think About It

“No man is an island, entire of itself; every man is a piece of the continent, a part of the main. If a clod be washed away by the sea, Europe is the less, as well as if a promontory were, as well as if a manor of thy friend’s or of thine own were: any man’s death diminishes me, because I am involved in mankind, and therefore never send to know for whom the bell tolls; it tolls for thee.”

—John Donne, writer and poet

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20220316.pdf

https://www.barrons.com/articles/feds-rate-rises-drag-stocks-down-51647466599?mod=article_inline (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/03-21-22_Barrons_The%20Market%20Rose%20on%20the%20Feds%20Rate%20Hikes_3.pdf)

https://www.barrons.com/articles/stock-market-dow-nasdaq-sp-500-51647648789?refsec=the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/03-21-22_Barrons_The%20Stock%20Market%20Just%20Had%20Its%20Biggest%20Gain%20Since%202020_4.pdf)

https://www.economist.com/the-economist-explains/2021/11/04/changing-the-clocks-is-unpopular-why-do-it (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/03-21-22_The%20Economist_Changing%20Clocks%20is%20Unpopular_5.pdf)

https://www.congress.gov/bill/117th-congress/senate-bill/623

https://www.bloomberg.com/news/articles/2022-03-16/what-year-round-daylight-saving-time-would-mean-quicktake (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/03-21-22_Bloomberg_What%20Year-Round%20Daylight%20Saving%20Time%20Would%20Mean_8.pdf)