Market Commentary

By Category

Market Commentary

Oct 12, 2022Weekly Market Commentary

October 10, 2022

The Markets

Bah humbug!

Last week, OPEC+, which includes the Organization of the Petroleum Exporting Countries and allied oil producers like Russia, chose to cut production by two million barrels a day. The stated goal is to keep crude oil prices above $90 a barrel. The production cut, which will push gasoline and other prices higher, complicates efforts to fight inflation, reported Salma El Wardany and colleagues at Bloomberg.

According to economic data, the Federal Reserve’s inflation fight has produced mixed results, so far. Like the ghosts that visit Scrooge in A Christmas Carol, economic data offers information about what has happened in the past, what is occurring in the present, and what could happen in the future. Recently, the data has been sending mixed signals. Nicholas Jasinski of Barron’s explained:

“For the early part of this past week, a bad-news-is-good-news mentality ruled as each ‘disappointment’ was greeted with a surge. Fueled by data showing softer manufacturing activity and a sharp decline in job openings, the [Standard & Poor’s 500 Index] put together a 5.7% jump on Monday and Tuesday…It was all downhill from there, though, as hawkish remarks from Fed officials, stronger services data and Friday’s jobs report drove home the point that we’re still a ways away from an economy or labor market that justifies the end of tightening.”

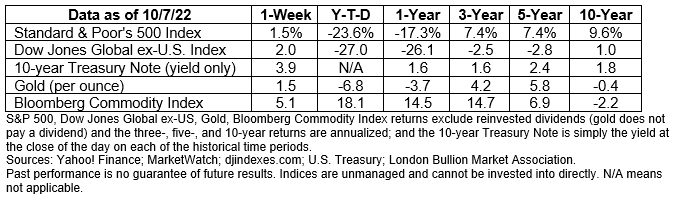

Stock prices are considered to be a leading indicator. They offer information about what investors expect to happen in the future. Last week, investors changed their minds mid-week. Despite price volatility, major U.S. stock indices finished the week higher.

U.S. Treasury yields moved higher last week, too, with the yield on the two-year Treasury finishing the week at 4.3 percent, while the yield on the 10-year Treasury finished at 3.9 percent. When short-term yields are higher than long-term yields, the yield curve is “inverted,” which has historically been a sign that the bond market thinks the U.S. is headed for a recession.

“The shape of the curve is among the most widely watched financial-market barometers because it reflects bondholders’ views of where interest rates and the economy are headed. When the curve inverts, with long yields dropping below short ones, it signals expectations of a slowdown that will drive rates lower in the future,” reported Michael Mackenzie and Ye Xie of Bloomberg.

It’s difficult to know what will happen in the future. That’s why investment portfolios are built around investors’ short- and long-term financial goals. It is easy to lose sight of your goals, though, when markets are volatile. If you’re feeling overwhelmed and uncertain, please get in touch. We’re happy to talk about your concerns and help you find solutions.

AND THE WINNER IS…They didn’t get as much press as the Nobel Prizes, but10 Ig Nobel Prize winners were also named recently. The Igs honor “…achievements that make people laugh, then think. Good achievements can also be odd, funny, and even absurd, so can bad achievements. A lot of good science gets attacked because of its absurdity. A lot of bad science gets revered despite its absurdity.”

This year’s winners included scholars of scorpion constipation, duckling swimming, ice cream cryogenics, romantic heart rate synchronization and other scintillating scientific topics. For example,

- The Biology Prize went toSolimary García-Hernández and Glauco Machado for “Short- and Long-Term Effects of an Extreme Case of Autotomy: Does ‘Tail’ Loss and Subsequent Constipation Decrease the Locomotor Performance of Male and Female Scorpions”

To escape predation, some types of scorpions shed their tails, losing a portion of their digestive tracts. This causes constipation. García-Hernández and Machado’s research investigated whether scorpions’ ability to move was affected by the change. They found that running speed was unaffected over the short-term. However, over the longer-term, tail loss and constipation hurt the running speed of males but not females.

- The Economics Prize went to Alessandro Pluchino, Alessio Emanuele Biondo, and Andrea Rapisarda for “Talent vs. Luck: The Role of Randomness in Success and Failure.”

Western culture often asserts that success is the result of talent, intelligence, hard work, commitment and other personal traits. The research found that luck plays an outsized role. The researchers used mathematics to explain “why success most often goes not to the most talented people, but instead to the luckiest.” This was the second Ig for Pluchino and Rapisarda, whose previous win was for a paper explaining that promoting people at random could make organizations more efficient.

- The Peace Prize went to Junhui Wu, Szabolcs Számadó, and their co-authors for “Honesty and Dishonesty in Gossip Strategies: A Fitness Interdependence Analysis.”

The researchers investigated gossip and developed a mathematical model for honest and dishonest gossip. During their acceptance speech, the researchers explained, “…gossiping people can be honest or dishonest, depending on how much they value the targets and recipients of gossip.”

Each of the Ig Nobel winners received a $10 trillion Zimbabwean banknote worth about far less than one trillion dollars. The awards were presented by actual Nobel Prize winners.

Weekly Focus – Think About It

“The most difficult thing is the decision to act, the rest is merely tenacity.”

—Amelia Earhart, aviator

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bloomberg.com/news/articles/2022-10-05/opec-panel-recommends-2-million-barrel-cut-to-output-limits (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-10-22_Bloomberg_OPEC+%20Rebuked%20by%20US%20After%20Cutting%20Output%20to%20Keep%20Prices%20High_1.pdf

https://www.barrons.com/articles/the-stock-market-fought-the-fedand-paid-the-price-51665187660?mod=hp_columnists (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-10-02_Barrons_The%20Stock%20Market%20Fought%20the%20Fed%20and%20Paid%20the%20Price_2.pdf)

https://www.conference-board.org/data/bci/index.cfm?id=2160

https://www.bloomberg.com/news/articles/2022-10-06/bond-market-sees-once-easy-yield-curve-bets-upended-by-fed-path (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-10-22_Bloomberg_Bond%20Market%20Sees%20Once%20Easy%20Yield-Curve%20Bets%20Upended%20by%20Fed%20Path_5.pdf)

https://onlinelibrary.wiley.com/doi/10.1111/1749-4877.12604

https://www.youtube.com/watch?v=uSELZ1A5OT8 [1:05 to 1:08]

https://www.inc.com/peter-economy/17-empowering-quotes-from-strong-women.html