Market Commentary

By Category

Market Commentary

Nov 14, 2022Weekly Market Commentary

November 14, 2022

The Markets

Last week was remarkable for many reasons.

One reason is that sky watchers around the world had an opportunity to see a total lunar eclipse. The moon, Earth and sun aligned, causing the moon to appear crimson. We won’t see another total lunar eclipse for three years, reported Denise Chow of NBC News.

Another reason, and one that’s far more important to consumers and investors, is that data suggested inflation may be waning. The Consumer Price Index, which is a measure of inflation, was released last week. It showed that prices rose more slowly than expected in October. On an annual basis:

- Headline inflation fell to 7.7 percent in October from 8.2 percent in September.

- Core inflation, which excludes food and energy prices, fell to 6.3 percent in October from 6.6 percent in September.

Investors were enthusiastic, hoping the Federal Reserve (Fed) might begin to take a more measured approach to monetary policy tightening. Fed officials were probably happy, too, although inflation remains well above their two percent target. “Central bank officials have emphasized they will need to see several months of deceleration in price gains before they will be convinced they have made progress in their fight against inflation,” reported Megan Cassella of Barron’s.

The inflation news may lift consumers’ spirits, too. Last week, the University of Michigan Consumer Sentiment Surveyreported that sentiment dropped sharply in October, erasing about half of recent gains. “Instability in sentiment is likely to continue, a reflection of uncertainty over both global factors and the eventual outcomes of the election,” reported Surveys of Consumers Director Joanne W. Hsu.

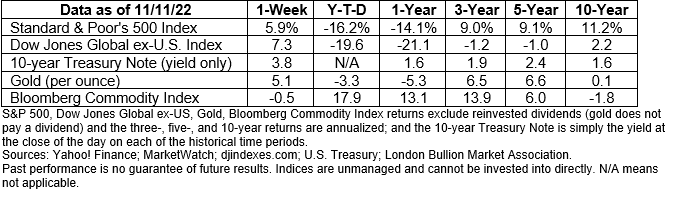

Last week, the Standard & Poor’s 500 Index finished the week up 5.9 percent, the Dow Jones Industrial Average gained 4.1 percent, and the Nasdaq Composite rose 8.1 percent, reported Avi Salzman of Barron’s. Treasury yields declined although the yield curve remained inverted.

IT WAS A DIFFICULT WEEK FOR MARKET GENIUSES. Last week, there was extraordinary drama in financial markets. It made the ups and downs of stock and bond markets seem almost mundane. Here’s what happened:

Tales from cryptocurrency. The world’s third largest cryptocurrency exchange declared bankruptcy after suffering the 21st century equivalent of a bank run. It was similar to the townspeople crowding into the Bailey Building and Loan in Frank Capra’s It’s a Wonderful Life. In the film, George Bailey uses his honeymoon money to avoid a collapse. The founder of the cryptocurrency exchange had a shortfall of about $8 billion, reported Philip van Doorn of MarketWatch.

When asked about the bankruptcy, U.S. Treasury secretary Janet Yellen said that cryptocurrencies require careful regulation, reported Christopher Condon of Bloomberg. “In other regulated exchanges, you would have segregation of customer assets,” Yellen said. “The notion you could use the deposits of customers of an exchange and lend them to a separate enterprise that you control to do leveraged, risky investments – that wouldn’t be something that’s allowed.”

It’s not easy. A popular social media company was recently privatized, which means that all shares of its stock were purchased by a new owner, and it no longer trades on a stock exchange. In this case, the purchaser was one of the world’s wealthiest individuals, who used his own money along with $13 billion in financing from large investors and private banks, reported Reuters.

The owners of privately held companies are not constrained by regulation or boards of directors, which can be advantageous, although that hasn’t proven out in this case, so far. The company’s new leader implemented a subscription service that produced undesirable results. “Once the option was available, users started creating accounts pretending to be major brands and politicians, fooling users and potentially jeopardizing [the social media company’s] now-shaky reputation with top advertisers,” reported Davey Alba and Kurt Wagner of Bloomberg.

“Companies led by lone geniuses need strong governance first and foremost,” said Yale School of Management’s Jeffrey Sonnenfeld in an interview with CNBC. “Having built-in checks and balances and a board that has field expertise as well as the ability to watch out for mission creep is critical to allowing these businesses to function with less risk of costly blunders.”

Weekly Focus – Think About It

“These are the times in which a genius would wish to live. It is not in the still calm of life, or the repose of a pacific station, that great characters are formed. The habits of a vigorous mind are formed in contending with difficulties. Great necessities call out great virtues. When a mind is raised, and animated by scenes that engage the heart, then those qualities which would otherwise lay dormant, wake into life and form the character of the hero and the statesman.”

—Abigail Adams, Founding Mother

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.bls.gov/news.release/archives/cpi_10132022.htm

https://www.barrons.com/articles/cpi-report-october-inflation-rate-51668038942 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/11-14-22_Barrons_Inflation%20is%20Falling_4.pdf)

https://www.barrons.com/articles/an-inflation-reading-sends-stocks-soaring-as-if-it-were-2020-51668216842?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/11-14-22_Barrons_Why%20the%20Bear%20Market%20Isnt%20Over_6.pdf)

https://www.bloomberg.com/news/articles/2022-11-12/yellen-says-ftx-debacle-shows-need-for-crypto-regulation (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/11-14-22_Bloomberg_FTX%20Debacle%20Shows%20Need%20for%20Crypto%20Regulation_9.pdf)

https://www.bloomberg.com/news/articles/2022-11-11/musk-s-twitter-staff-shift-focus-from-midterms-to-brand-fakes (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/11-14-22_Bloomberg_Twitter%20Staff%20Grapple%20with%20Brand%20Impostors_12.pdf) [1]3 https://www.cnbc.com/2022/11/12/from-elon-musk-to-sam-bankman-fried-a-bad-week-for-market-geniuses.html