Market Commentary

By Category

Market Commentary

Dec 05, 2022Weekly Market Commentary

December 05, 2022

The Markets

What will it take to slow this economy down?

In 2001, railway workers slowed a runaway train in Ohio by latching a second engine to the back of the locomotive and applying the brakes. In all, the train traveled sixty-six miles over two hours, decelerating from a maximum speed of 47 miles per hour to 10 miles per hour before workers regained control of it, according to CNN.

Throughout 2022, the United States Federal Reserve has been trying to slow inflation by putting the brakes on the U.S. economy. So far, the Fed has raised rates six times, but the economy continues to grow apace. Last week, the Bureau of Economic Analysis reported the economy grew faster than originally thought from July through September 2022. Gross domestic product (GDP), which is the value of all goods and services produced by the U.S., was up 2.9 percent, annualized, rather than 2.6 percent as the advance estimate indicated.

Last week’s unemployment report also suggested the economy remains strong. More jobs were added than economists expected, and the unemployment rate remained at 3.7 percent. Average hourly earnings also increased faster than expected, up 5.1 percent over the last 12 months.

Megan Cassella of Barron’s reported, “The biggest outstanding obstacle to the Federal Reserve’s success in reining in inflation boils down to a numbers problem: There aren’t enough workers in the [United States]. Simply put, labor supply and demand need to come back into balance to contain wage growth and services inflation, which continues to climb…A combination of factors is contributing to the dearth of workers, from Baby Boomer retirements and falling immigration to a low birth rate and long COVID. Together, they suggest that shortages are here to stay.”

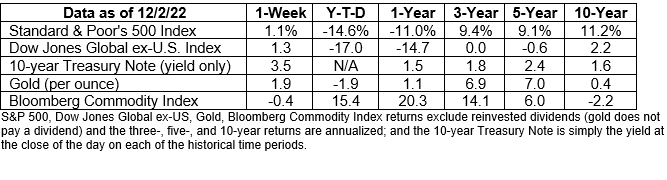

Last week, stock and bond markets rallied following Fed Chair Jerome Powell’s mid-week speech, in which he confirmed it was likely December’s rate increase would be smaller than the last few increases have been. Later in the week, the strong employment report checked investors’ enthusiasm. Regardless, major U.S. indices finished higher, reported Nicholas Jasinski of Barron’s, and Treasury yields finished the week mostly lower.

CAN YOU BELIEVE IT’S DECEMBER ALREADY? According to Andy Williams, Garth Brooks and Kylie Minogue, “It’s the Most Wonderful Time of the Year.” During December, holiday enthusiasts don ugly sweaters, wheedle recipes out of relatives, light a wealth of candles, and celebrate a diversity of holidays. See what you know about this magical time of the year by taking our brief quiz.

- Which of the following holidays is NOT celebrated in December?

- International Ninja Day

- Sacher-Torte Day

- Dewey-Decimal System Day

- National Take Down the Christmas Tree Day

- Scientists have studied the psychology of gift giving. They find that the most valued presents are:

- Expensive gifts that make others envious

- Beautifully wrapped gifts that are pleasing to the eye

- Sentimental gifts that bring joy and happiness

- Thoughtful gifts that reflect the recipient’s hobbies and interests

- Which generation is expected to spend the most ($1,823) on gifts, travel and entertainment this holiday season?

- Gen Z (Ages 9 to 24)

- Millennials (Ages 25 to 40)

- Gen X (Ages 41 to 56)

- Boomers (Ages 57 to 75)

- When did the New Year’s Eve ball drop first take place in Times Square? (Hint: Teddy Roosevelt was President.)

- 1893

- 1907

- 1920

- 1945

If you have any questions, get in touch.

Weekly Focus – Think About It

“Gratitude unlocks the fullness of life. It turns what we have into enough, and more. It turns denial into acceptance, chaos to order, confusion to clarity. It can turn a meal into a feast, a house into a home, a stranger into a friend.”

—Melody Beattie, author

Answers: 1) d; 2) c; 3) b; 4) b

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.cnn.com/2001/US/05/15/runaway.train.05/

https://www.bls.gov/news.release/empsit.nr0.htm (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/12-05-22_Barrons_Why%20the%20Fed%20Must%20Cause%20More%20Pain%20to%20the%20Job%20Market_4.pdf)

https://www.barrons.com/articles/fed-interest-rate-hike-inflation-wage-growth-job-market-51670025045 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/12-05-22_Barrons_Stocks%20Rise%20on%20Cooling%20Inflation%20and%20Fed%20Moderation_5.pdf)

https://en.wikipedia.org/wiki/It%27s_the_Most_Wonderful_Time_of_the_Year

https://www.brainyquote.com/authors/melody-beattie-quotes

https://nationaltoday.com/january-holidays/#jan-6

https://www.sciencedirect.com/science/article/abs/pii/S105774081730044X

https://www.pwc.com/us/en/industries/consumer-markets/library/2022-holiday-outlook-trends.html