Weekly Market Commentary

By Category

Weekly Market Commentary

Jun 09, 2025Weekly Market Commentary

June 09, 2025

The Markets

Employment was top of mind for financial markets last week.

Economists and investors hoped May employment information would provide insight to the state of the United States economy, as well as clues about when the Federal Reserve (Fed) may lower the federal funds rate again.

Employment data arrives in two reports that offer different perspectives on the employment situation. Last week, the trends were similar – new jobs creation slowed from April to May – although the number of new jobs reported was quite different. Here’s a brief overview:

+37,000 new jobs per the ADP National Employment Report. Mid-week, this supplemental report showed fewer new jobs were added in May (37,000 new jobs) than had been created in April (62,000 new jobs).

“That was a big miss vis-a-vis what economists were expecting, and so we saw a negative market reaction initially. But if you talk to economists, guess what, they say that ADP number is not a very good predictor of the [Bureau of Labor Statistics] number, and they really give it much less weight, if any weight at all,” reported Julie Hyman of Yahoo!Finance.

+ 139,000 new jobs per the Bureau of Labor Statistics (BLS). On Friday, the government’s Employment Situation Summary reported more jobs were created than economists had anticipated. However, jobs growth slowed from April (147,000 new jobs) to May (139,000 new jobs), and initial estimates for March and April were revised lower.

“While the headline number came in higher than expected, previous months were revised lower — a pattern which has been repeating itself for a while now and which has prompted a lot of head-scratching,” reported Tracy Alloway and Joe Weisenthal of Bloomberg.The pair cited a source who believes one reason for the revisions is that key data about U.S. business closures and business openings arrives after the initial report is issued.

The unemployment rate, which is determined by a survey of households, remained steady at 4.2 percent in May. “…the household survey found a 625,000 decline in the labor force, which helps the jobless rate since those not in the workforce aren’t counted as unemployed,” reported Randall Forsyth of Barron’s.

So, what did the report tell us about the economy and prospective Fed rate policy? “Not as bad as feared but not as good as it looks. That’s what the latest employment data show. But for financial markets, the numbers suggest that the Federal Reserve may be slower to lower interest rates,” reported Forsyth.

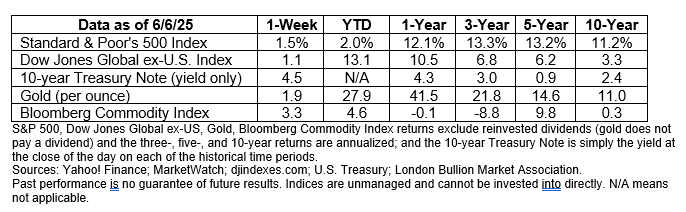

By the end of the week, major U.S. stock indexes were all in positive territory year-to-date, reported Connor Smith of Barron’s. Yields onlonger maturities of U.S. Treasuries moved higher over the week.

ABOUT BORROWING AND LENDING. In the United States, many people engage in short-term borrowing. They use credit cards to acquire goods or services – springing for a dinner out, charging the cost of a new video game, or purchasing a replacement refrigerator. Then, they pay the money back. If the credit cardholder doesn’t reimburse the card provider in full each month, then they will owe interest on the money they’ve borrowed. Buying on credit is fast and convenient, and it can be quite profitable for the lender.

In China, the payment system can work differently. It’s more of a “pay now and buy later” approach where buyers lend their money to companies, reported The Economist.

“When you get a haircut or eat at a restaurant, the seller encourages you to pay in advance for multiple transactions. You might pay upfront for ten haircuts, or put 1,000 yuan ($140) on a pre-paid card, and the business will, in return, give you extra credit to spend… The bonus the firm adds to the customer’s deposit rises with the size of the initial outlay, and can be large. Customers putting down 10,000 yuan can receive an extra 2,000 yuan to spend in the store. If they use the money within a year, that amounts to an annual “interest” rate of 20 [percent], paid in kind.”

See what you know about borrowing and lending by taking this brief quiz.

- If the Chinese system seems familiar, it may be because it’s similar (in some ways) to gift cards. In 2024, Americans spent more than $300 billion on gift cards, according to a source cited by Charles Passy of MarketWatch. However, many Americans don’t use the gift cards they receive. That can make gift cards very profitable for companies. In 2024, a popular coffee retailer reported it had a significant amount of money stored in unredeemed gift cards and did not expect most of the cards to ever be redeemed. How much money was it?

- $379 million

- $985 million

- $1.77 billion

- $4.56 billion

- When people buy bonds, they agree to lend their money to a government or organization. In return, the government or organization agrees to repay the loan and pay a specific amount of interest. Imagine that you lend your child $2,000 to buy a car. In exchange, they promise to repay you $200 a month (until the debt is repaid) and to mow your lawn every week. In this example, the lawn mowing would:

- Probably never happen.

- Represent the repayment of principal.

- Represent the payment of interest on the loan.

- Be your reward for being a wonderful parent.

- A credit score offers insight to a person’s financial circumstances at a specific time, and helps financial institutions decide whether to lend to a person or not. The practice began in 1989 when the first credit-scoring algorithm was created. How many credit scores can a person have?

- One

- Three

- Fourteen

- Hundreds

- When people buy homes, the mortgage rates received are based on a specific benchmark. When the benchmark rate is higher, so is the mortgage rate. What is the benchmark for the 30-year mortgage rate?

- The 5-year average return of the Standard & Poor’s 500 Index

- The Federal Open Market Committee federal funds rate

- The 10-year U.S. Treasury note rate

- The Big Mac Index

Weekly Focus – Think About It

“The pleasure of rooting for Goliath is that you can expect to win. The pleasure of rooting for David is that, while you don’t know what to expect, you stand at least a chance of being inspired.”

– Michael Lewis, Author

Answers: 1) c; 2) c; 3) d; 4) c

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://finance.yahoo.com/video/private-vs-govt-jobs-where-214534342.html

https://www.bls.gov/news.release/empsit.nr0.htm (report and Table B)

https://www.bloomberg.com/news/newsletters/2025-06-06/america-s-data-disaster-is-already-here? or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/06-09-25-Bloomberg-Americas-Data-Disaster%20-%205.pdf

https://www.barrons.com/livecoverage/stock-market-news-today-060625?mod=hp_LEDE_C_2 or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/06-09-25-Barrons-The-Bottom-Line-of-the-Jobs-Report%20-%207.pdf

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2025 or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/06-09-25-Barrons-Stocks-Rally-In-Wake%20-%208.pdf

https://www.investopedia.com/how-do-credit-cards-work-5025119#

https://www.economist.com/china/2025/05/29/chinas-crazy-reverse-credit-cards or go to https://resources.carsongroup.com/hubfs/WMC-Source/2025/06-09-25-Economist-Chinas-Crazy-Reverse-Credit-Cards%20-%2010.pdf

https://www.econlib.org/library/Topics/Details/bonds.html

https://www.fanniemae.com/research-and-insights/publications/housing-insights/rate-30-year-mortgage