Weekly Market Commentary

By Category

Weekly Market Commentary

Jun 05, 2023Weekly Market Commentary

June 05, 2023

The Markets

As Gomer Pyle used to say, “Surprise, surprise, surprise!”

Gomer Pyle USMC was a popular American sitcom in the 1960s. It focused on a naïve, do-gooding auto mechanic from Mayberry RFD who joined the military. Gomer Pyle, the much-loved main character, was known for catchphrases such as shazam, golly, and surprise, surprise, surprise.

Surprise. Last week, the continued strength and resilience of the labor market was a revelation. The Federal Reserve has raised rates 10 times over the last 14 months, trying to slow economic growth and drive inflation lower, reported Jeff Cox of CNBC. In theory, higher rates should have cooled the labor market and led to higher unemployment rates. So far, that hasn’t happened.

Last week, theJob Openings and Labor Turnover Survey (JOLTS) showed the number of job openings in the United States increased from March to April, while the number of people separating from employers fell. Then, the Bureau of Labor Statistics’ employment report showed that more jobs were created in May than anyone anticipated.

Surprise. It was also surprising that investors took the news about labor markets in stride. Economic data suggesting the economy remains strong could cause the Fed to raise rates again in June rather than taking a pause as many hope it will. Nicholas Jasinski of Barron’s offered a possible explanation.

“While the [labor market] strength might not be what the Federal Reserve wants, it’s great news for investors because there continues to be no sign of a slowing economy – let alone a recession – in the labor market data. That means there’s no impending slowdown to hit corporate earnings and drag down stock prices, and it’s helping to send cyclical sectors higher…”

Surprise. Investors don’t expect the Federal Reserve to increase rates in June, despite strength in the labor market. That may be because the employment report also offered hints that the economy may be softening. For instance, the unemployment rate rose to 3.7 percent as unemployment among women and Black Americans increased. In addition, the average length of the work week shortened slightly, and the pace of average hourly wage increases slowed.

Last week, major U.S. stock indices gained, according to Barron’s. Yields on U.S. Treasuries with maturities of one-year or longer finished the week lower as policymakers voted to raise the debt ceiling.

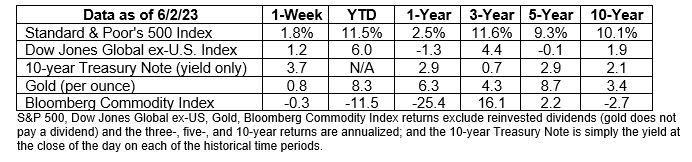

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

ABOUT THE NATIONAL DEBT…Americans are more concerned about reducing the budget deficit than they have been in the past, according to a Pew Researchsurvey.

When the United States spends more than it receives, there is a budget shortfall (aka, a deficit). Each annual deficit adds to previous annual deficits. The total of all deficits (offset by any surpluses) plus interest owed is the national debt. So far this year, the U.S. Treasury reports the government has:

- Received $2.7 trillion (less than last year).

- Spent $3.6 trillion (more than last year).

- A year-to-date shortfall is $925 billion.

When that shortfall is added to the total already owed, the national debt is about $31.5 trillion. Our national debt includes two types of borrowing:

78 percent is publicly held debt ($24.6 billion). This includes Treasury securities sold to investors at home and abroad. The amount has grown by 106% since 2013. One of the biggest owners of public debt is the Federal Reserve system, which holds almost 20 percent of publicly held national debt, according to Pew Research.

22 percent is intragovernmental debt ($6.9 trillion). The U.S. government owes this money to federal trust funds and accounts. The amount has grown by 40 percent since 2013. One of the government’s biggest creditors is the Social Security system. “…the program’s retirement and disability trust funds together held more than $2.8 trillion in special non-traded Treasury securities, or 9% of the total debt.”

Last week, Congress voted to raise the debt ceiling, which is the limit on the national debt.

Weekly Focus – Think About It

“Things never go the way you expect them to. That’s both the joy and frustration in life. I’m finding as I get older that I don’t mind, though. It’s the surprises that tickle me the most, the things you don’t see coming.”

—Michael Stuhlbarg, actor

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://en.wikipedia.org/wiki/Gomer_Pyle,_U.S.M.C.

https://www.cnbc.com/2023/05/03/fed-rate-decision-may-2023-.html

https://www.bls.gov/news.release/jolts.nr0.htm

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.barrons.com/articles/stock-market-jobs-report-71e4e6a?mod=hp_LEAD_1 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-05-23_Barrons_Jobs%20Report%20was%20Very%20Strong_5.pdf)

https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-05-23_Barrons_Data_6.pdf)

https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/ (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-05-23_FiscalData_How%20Much%20Revenue%20Has%20the%20US%20Government%20Collected%20this%20Year_9-1.pdf)

https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/ (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-05-23_FiscalData_How%20Much%20Has%20the%20US%20Government%20Spent%20This%20Year_10.pdf)

https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/ (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-05-23_Fiscal%20Data_What%20is%20the%20National%20Deficit%202023_11-1.pdf)

https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/ (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/06-05-23_What%20is%20the%20National%20Debt_12.pdf)

https://www.brainyquote.com/quotes/michael_stuhlbarg_512313?src=t_surprises