Weekly Market Commentary

By Category

Weekly Market Commentary

Oct 09, 2023Weekly Market Commentary

October 09, 2023

The Markets

Financial markets lost ground during the third quarter.

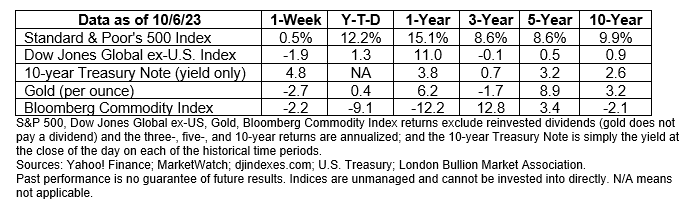

While year-to-date returns for the Standard & Poor’s (S&P) 500 Index remain above the historic average, which was 10.24 percent, including dividends, from 1973 to 2022, the rally in U.S. stocks stalled during the third quarter of 2023, reported Lewis Krauskopf, Ankika Biswas and Shashwat Chauhan of Reuters.

Early in the quarter, U.S. stocks gained, driven higher by better-than-expected corporate earnings, falling inflation and optimism that the Federal Reserve (Fed) might be near the end of its rate-hiking cycle. Since March of 2022, the Fed has lifted the Federal Funds effective federal funds rate from near zero to 5.33 percent and reduced its bond holdings by $1 trillion through quantitative tightening, reported Michael S. Derby of Reuters.

The Fed’s actions are designed to bring inflation lower by slowing economic growth and reducing demand for goods and services. However, the U.S. economy continues to hum along. The labor market has been particularly resilient. Last week’s employment data showed number of jobs created in September was almost double the Dow Jones consensus estimate, reported Jeff Cox of CNBC. The U.S. unemployment rate remained near historically low levels, and the labor force participation rate increased over the quarter.

The strong economy has been a source of significant uncertainty. Some economists believe it is an indication the Fed has engineered a soft landing and inflation will reach targeted levels without a recession, although 60 percent of the economists surveyed by Bloomberg continue to say a recession is ahead, reported Rich Miller, Molly Smith and Kyungjin Yoo.

Government turmoil also has created uncertainty. In early August, Fitch Ratings surprised financial markets by lowering its rating on U.S. Treasuries from AAA to AA+. The company indicated that “a high and growing general government debt burden, and the erosion of governance” were the impetus for the downgrade.

In September, when Congress debated whether to approve the necessary appropriations bills to fund the U.S. government for fiscal 2024, Moody’s Investors Service – the only remaining major credit rating agency to award U.S. Treasuries a AAA rating – warned that a government shutdown would be a “credit negative” event, reported Matt Phillips of Axios. Congress temporarily avoided a government shutdown by passing a continuing resolution that provides funding through mid-November.

By the end of the quarter, optimism that the end of the Fed’s tightening cycle was near had faded amid uncertainty about the strength of the economy, the possibility of a government shutdown, and a growing number of labor disputes.In late September, the Fed released its economic projections, making it clear that an additional rate hike was possible in 2023, and rate cuts were unlikely before 2024.

The Fed’s hawkish outlook helped push stock and bond markets lower. In late September, the S&P 500 Index was down about 7 percent from its July high. From August through September, the yield on the 10-year U.S. Treasury note rose from 4.05 percent to 4.59 percent. Bond prices fall as yields rise.

Last week, despite the strong jobs report bolstering the likelihood of another Fed rate hike, the S&P 500 and Nasdaq Composite Indices moved higher. The Dow Jones Industrial Index lost ground. Yields on U.S. Treasuries generally moved higher over the week.

STRANGE BUT TRUE…The animal world is filled with wonders. For example, National Geographic reports that the world’s lightest mammal is the Bumblebee bat. It weighs in at two grams – about the same as two standard paper clips. See what you know about recent occurrences in the natural world by taking this brief quiz.

- Flamingos that may have been flying from Cuba to the Yucatan were blown off course by Hurricane Idalia. So far, they’ve been found in 12 U.S. states, according to news reports. What is the northernmost state where they have been found?

- Minnesota

- Wisconsin

- Montana

- Alaska

- Scientists believe that the ability to solve problems independently is a sign of intelligence among animals. In a recent study, scientists scattered “puzzle boxes with three differently configured compartments that contained highly aromatic jackfruit” across an area to see whether Asian elephants would be willing and able to open the boxes. How many of the 44 elephants that approached the boxes were able to figure out at least one way to open them?

- 37

- 24

- 11

- 4

- Blue is one of the rarest colors in nature. Last year, explorers in Thailand found a new species of creature with iridescent blue patches on its body. What type of creature was it?

- A sloth

- A snail-eating snake

- A tarantula

- An owl

Weekly Focus – Think About It

Dreams

By Langston Hughes

Hold fast to dreams

For if dreams die

Life is a broken-winged bird

That cannot fly.

Hold fast to dreams

For when dreams go

Life is a barren field

Frozen with snow.

Answers: 1) b; 2) c; 3) c

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-09-23_Historical%20Returns_1.pdf)

https://www.reuters.com/markets/us/futures-climb-treasury-yields-ease-ahead-key-inflation-data-2023-09-29/ https://www.newyorkfed.org/markets/reference-rates/effr

https://www.cnbc.com/2023/10/06/jobs-report-september-2023.html

https://www.bls.gov/news.release/empsit.a.htm

https://www.bloomberg.com/news/articles/2023-07-21/us-recession-becomes-closer-call-as-economists-rethink-forecasts?embedded-checkout=true (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-09-23_Bloomberg_US%20Recession%20Becomes%20Closer%20Call_7.pdf)

https://www.axios.com/2023/09/25/government-shutdown-us-credit-rating-moodys

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230920.pdf

https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-09-23_Barrons_Data_13.pdf)

https://kids.nationalgeographic.com/weird-but-true/article/animals

https://www.batcon.org/bat/craseonycteris-thonglongyai-2/

https://www.wisn.com/article/flamingo-sighting-lake-michigan-wisconsin/45269142#

https://www.sciencedaily.com/releases/2023/09/230928152537.htm