Weekly Market Commentary

By Category

Weekly Market Commentary

Feb 12, 2024Weekly Market Commentary

February 12, 2024

The Markets

China is out of favor with investors.

For decades, China was among the fastest-growing economies in the world. Its real gross domestic product, which is the value of all goods and services it produces, grew by about nine percent a year, on average, from 1978 through 2022, according to The World Bank. However, the pace of economic growth in China slowed over the last decade and dropped sharply during the pandemic.

Many investors expected China to rebound quickly in 2023 after its Zero Covid policy ended, but that hasn’t happened. Instead, “Exports weakened and deflation deepened, but the big letdown was consumer spending, which slumped as young people struggled to find jobs and the long awaited reckoning for the housing market finally arrived,” reported Allen Wan of Bloomberg.

China’s stock market performance reflected its economic malaise. “The market value of China’s and Hong Kong’s shares is down by nearly $7 [trillion] since its peak in 2021. That is a fall of around 35%, even as [the market value] of America’s stocks has risen by 14%, and India’s by 60%,” reported The Economist via X.

In recent months, investors have been pulling money out of China. “Much of that cash is now heading for India, with Wall Street giants…endorsing the South Asian nation as the prime investment destination for the next decade. That momentum is triggering a gold rush…The euphoria has made Indian equities among the most expensive in the world,” reported Srinivasan Sivabalan, Chiranjivi Chakraborty, and Subhadip Sircar of Bloomberg.

The Chinese government has been trying to stimulate growth and reassure investors. In late January, “the People’s Bank of China announced a larger-than-expected cut in banks’ required reserve ratio…But sentiment remains about as downbeat as can be, despite reports that authorities are considering a package to bolster the stock market totaling some two trillion yuan (almost $280 billion). That’s not just among Chinese domestic investors—that negativity is shared around the world,” reported Randall Forsyth of Barron’s.

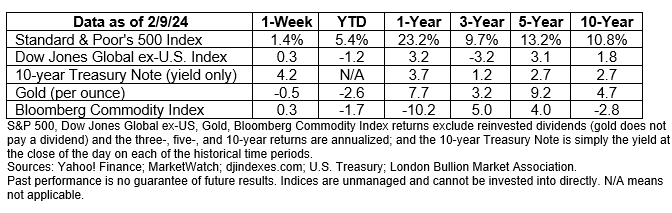

In contrast, U.S. investors have been bullish. Last week, the Standard & Poor’s 500 Index closed above 5,000 for the first time. The U.S. Treasury bond market remained relatively steady as yields on many maturities of Treasuries finished the week about where they started it.

HOW MUCH DOES A THUNDERSTORM COST? The insurance industry has been examining this question closely. From 2000 to 2022, the median economic loss from severe convective storms (SCS, aka severe thunderstorms) around the world was about $39 billion, according to a report from a 2024 global professional services firm. In 2023:

- Severe thunderstorms inflicted $94 billion worth of economic damage across the globe,

- 28 of the storms were billion-dollar events, and

- 23 of the billion-dollar storms occurred in the United States.

Overall, thunderstorms were the most damaging peril for insurance companies last year. They took seven of the top-10 spots on the list of global insured loss events in 2023.

- U.S. drought $6.5 billion insured loss/ $14.0 billion economic loss*

- Turkey/Syria earthquakes $5.7 billion insured loss/ $92.4 billion economic loss

- U.S. severe thunderstorm $5.0 billion insured loss/ $6.2 billion economic loss

- U.S. severe thunderstorm $4.4 billion insured loss/ $5.5 billion economic loss

- U.S. severe thunderstorm $4.3 billion insured loss/ $5.3 billion economic loss

- Hawaii wildfires $3.5 billion insured loss/ $5.5 billion economic loss

- U.S. severe thunderstorm $3.1 billion insured loss/ $3.9 billion economic loss

- U.S. severe thunderstorm $3.0 billion insured loss/ $3.8 billion economic loss

- Europe severe thunderstorm $3.0 billion insured loss/ $5.8 billion economic loss

- U.S. severe thunderstorm $2.9 billion insured loss/ $3.6 billion economic loss

*Insured loss is the portion of an economic loss covered by public or private insurance entities.

The chief climate scientist of a German multi-national insurer said, “We used to refer to regional thunderstorms as secondary perils because they only cause small or medium-sized damage on their own…But as the number of thunderstorms increases, we have to think about a new classification, reported Stephan Kahl of Bloomberg.”

Weekly Focus – Think About It

“Like a welcome summer rain, humor may suddenly cleanse and cool the earth, the air and you.”

—Langston Hughes, poet

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.worldbank.org/en/country/china/overview#1

https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?end=2022&locations=CN&start=1961&view=chart

https://twitter.com/TheEconomist/status/1755638119884329257 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-12-24_The%20Economist%20Tweet_4.pdf)

https://www.bloomberg.com/news/articles/2024-02-06/goldman-morgan-stanley-bet-on-india-stocks-as-wall-street-shifts-from-china (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-12-24_Bloomberg_Wall%20Street%20Snubs%20China_5.pdf)

https://www.barrons.com/articles/chinas-stocks-evergrande-crisis-d615ad97?mod (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-12-24_Barrons_Chinas%20Stocks%20Have%20Fallen%20for%20Three%20Years_6.pdf)

https://www.aaii.com/sentimentsurvey (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-12-24_AAII_What%20Direction%20Will%20Stock%20Market%20Be_7.pdf)

https://finance.yahoo.com/news/p-500-closes-above-5-020000148.html#

https://assets.aon.com/-/media/files/aon/reports/2024/climate-and-catastrophe-insights-report.pdf [Pages 4, 11, 13, 15 or see pdf] (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-12-24_AON_Climate%20and%20Catastrophe%20Insight_10.pdf)

https://www.bloomberg.com/news/articles/2024-01-09/natural-disasters-led-to-250-billion-in-global-losses-last-year (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-12-24_Bloomberg_Natural%20Disasters%20Led%20to%20250B%20in%20Global%20Losses_11.pdf)

https://www.brainyquote.com/quotes/langston_hughes_121611?src=t_humor