Weekly Market Commentary

By Category

Weekly Market Commentary

Feb 26, 2024Weekly Market Commentary

February 26, 2024

The Markets

Optimism abounds!

Enthusiasm for everything related to artificial intelligence (AI) drove a global stock market rally last week. Equity markets in the United States, Europe, and Japan hit all-time highs after a leading chipmaker reported better-than-expected earnings and an extraordinary surge in demand for its artificial intelligence-targeted processors, wrote Rita Nazareth of Bloomberg.

Investors took the news “as evidence that the generative AI boom is both real and spreading. [The company’s] spectacular earnings report and forward guidance are spurring investors to buy shares of almost any company with a stake in the AI race—everything from computer and networking hardware providers to cloud computing plays to enterprise application software,” reported Eric J. Savitz of Barron’s.

Investors weren’t the only ones feeling optimistic last week. Economists who participated in a February Bloomberg survey expect the U.S. economy to grow this year and next year, although a significant minority say that a recession is possible in 2025, reported Augusta Saraiva and Kyungjin Yoo of Bloomberg. They cited a source who stated:

“The U.S. economy remains the envy of the world…Both real economic growth and employment growth remain strong while inflation rates and interest rates are falling.”

Chief executive officers (CEOs) are feeling optimistic, too. The Conference Board Measure of CEO Confidence™ survey found that CEOs are feeling much better than they did at the end of last year.

- 32% said economic conditions were better than they were six months ago (up from 18% in the fourth quarter).

- 31% said conditions in their industries were better than they were six months ago (up from 27% in the fourth quarter).

- 36% expect economic conditions to improve over the next six months (up from 19% in the fourth quarter).

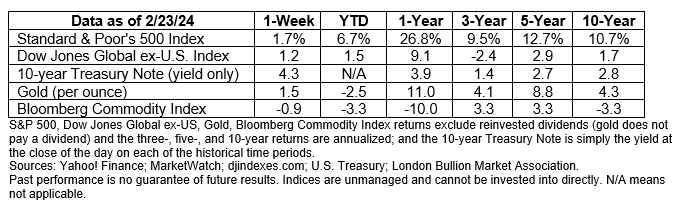

Last week, major U.S. stock indices moved higher, yields on longer maturities of U.S. Treasuries moved lower.

WHAT INFLUENCES STOCK MARKETS? People use all kinds of information to make investment decisions. Benjamin Graham, who was Warren Buffett’s mentor, thought the proper approach was to evaluate company fundamentals. Graham wrote, “The stock investor is neither right or wrong because others agreed or disagreed with him; he is right because his facts and analysis are right.”

British economist John Maynard Keynes cautioned that how “others” think about stocks can have a significant effect on performance. Keynes is famous for saying, “Markets can remain irrational longer than you can remain solvent.”

Meme stocks, which are shares of companies that become popular through social media, demonstrated Keynes’ point. These companies often have poor fundamentals, but their stock prices soar because they are well-liked online. Social sentiment indicators use aggregated social media data to evaluate how people feel about companies. These data can be valuable to asset managers because digital influence can affect stock prices.

While tracking digital sentiment is relatively new, some surveys have measured how people feel about the economy and financial markets for decades. These include:

- The University of Michigan Index of Consumer Sentiment. The index ticked higher in February. Over the last three months, it has seen the sharpest gains in 30 years; however, consumer sentiment remains below the index’s long-term average, reported Christopher Rugaber of the Associated Press.

- The AAII Investor Sentiment Survey. Investors remained more bullish than usual last week with 44.3 percent saying they expected markets to move higher over the next six months. The historic average is 37.5 percent bullish.

Many factors affect the value of stocks and stock markets. “…Investor confidence is only one of many forces on the market. Stock prices are of course determined by supply and demand, and there are numerous factors that affect these, fundamental factors, legal, tax-related, demographic, technological, international, as well as other psychological factors related to attention, regret, anchoring, and availability,” explained the International Center for Finance at Yale University.

Stock market performance also can be affected by geopolitical factors, like conflict in Ukraine and the Middle East.

Weekly Focus – Think About It

“A long habit of not thinking a thing wrong gives it a superficial appearance of being right.”

—Thomas Paine, founding father

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bloomberg.com/news/articles/2024-02-21/stock-market-today-dow-s-p-live-updates?srnd=premium (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-26-24_Bloomberg_Stocks%20Around%20World%20Are%20Swept%20Up%20in%20AI%20Rally_1.pdf)

https://www.barrons.com/articles/nvidia-ai-boom-amd-arm-super-micro-palantir-stock-price-29554905?mod=Searchresults (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-26-24_Barrons_Nvidias%20AI%20Boom%20Spurs%20Other%20Stocks_2.pdf)

https://www.bloomberg.com/news/articles/2024-02-23/recession-odds-dropping-as-economists-boost-us-growth-outlook (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-26-24_Bloomberg_Economists%20Lower%20Recession%20Forecasts%20to%2040%25_3.pdf)

https://www.conference-board.org/topics/CEO-Confidence

https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/02-26-24_Barrons%20Data_5.pdf)

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=2024027 https://www.investopedia.com/terms/b/bengraham.asp

https://www.goodreads.com/author/quotes/159357.John_Maynard_Keynes

https://www.cnbc.com/select/what-is-a-meme-stock/

https://www.finra.org/investors/insights/social-sentiment-investing-tools

https://apnews.com/article/economy-consumer-sentiment-election-f8d57248f2d3eff85c9fe391e41e21dd

https://www.aaii.com/sentimentsurvey

https://www.axios.com/2023/12/11/world-economy-threat-geopolitics-2024

https://www.brainyquote.com/quotes/thomas_paine_161749?src=t_thinking