Weekly Market Commentary

By Category

Weekly Market Commentary

Jun 03, 2024Weekly Market Commentary

June 03, 2024

The Markets

Overall, May was a good month for investors.

The adage, “Sell in May and go away,” would have been poor advice last month. Major stock indices in the United States finished the month higher. Connor Smith of Barron’s reported:

- The Nasdaq Composite was up 6.9 percent for May,

- The Standard & Poor’s 500 Index gained 4.8 percent, and

- The Dow Jones Industrial Average finished 2.3 percent higher.

Despite the positive returns, May was also a volatile month for stocks as investors worried about inflation and whether the Federal Reserve will begin to lower rates in 2024, reported Paul La Monica of Barron’s.

For much of last week, stocks trended lower.The Conference Board’s Consumer Confidence Index surprised by exceeding economists’ expectations for May, but it had little effect on investors as the report wasn’t rosy.

Confidence improved “…amid optimism about the labor market, but worries about inflation persisted and many households expected higher interest rates over the next year…The mixed survey…also showed more consumers believed that the economy could slip into recession in the next 12 months,” reported Lucia Mutikani of Reuters.

Late in the week, markets regained lost ground after the Personal Consumption Expenditures Price Index (one of the Federal Reserve’s preferred inflation gauges) data arrived. The Index showed that core inflation, which excludes volatile food and energy prices, ticked lower from March to April. Headline inflation remained steady month to month.

Year to year, headline inflation was 2.7 percent in April and core inflation was 2.8 percent.

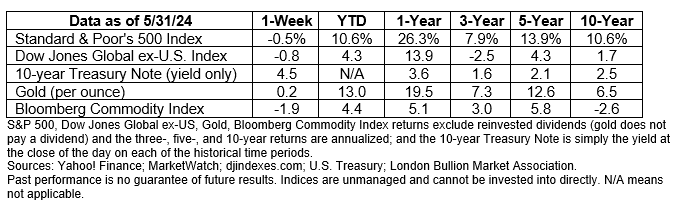

Major U.S. stock indices finished the week lower. The yield on the benchmark 10-year U.S. Treasury finished the week close to where it started the week.

YOUNGER GENERATIONS ARE FRUSTRATED WITH BABY BOOMERS. Thesaving and spending habits of baby boomers, born between 1946 and 1964, have been discussed in the news and on social media lately. Much of the discussion has focused on the wealth accumulated by the world’s baby boom generation. Boomers have, broadly speaking, acquired significant wealth over their lifetimes. The Economist reported that baby boomers in the United States comprise “20% of the country’s population, own 52% of its net wealth, worth $76 [trillion].”

Instead of congratulating a group that is likely to live longer in retirement than previous generations have, some conversations accuse boomers of hoarding wealth, while others suggest that policy mistakes by leaders in the cohort have held back younger generations economically.

Whether these discussions reflect the beliefs of younger generations is unclear. Regardless, boomers have solid reasons for spending slowly. These include:

Leaving an inheritance for younger generations. “Many boomers recognize how lucky they are to have accumulated such enormous wealth. They want to pass it on to their children, many of whom are struggling to buy a house or pay school fees… The flow of bequests from the dead to the living, as a share of GDP, is rising fast across the rich world. Americans inherit about 50% more each year than they did each year in the 1980s and 1990s, for instance.”

Living longer in retirement. Longevity risk is a significant concern for baby boomers, many of whom may spend 30 years or more in retirement. According to the Employee Benefits Research Institute’s Retirement Confidence survey, 32 percent of workers and 26 percent of retirees are not confident they will have enough money to live comfortably through retirement.

Keeping a reserve – just in case. British research found that older people who do not believe they will need long-term care are likely to spend their savings more quickly, while those who believe there is a possibility of becoming less mobile or developing dementia are likely to spend more slowly.

Planning for retirement is not a simple task, especially with the possibility of reduced Social Security benefits ahead. A new report from Goldman Sachs found that a majority of millennials and Gen Z are ahead on planning and saving for retirement, while almost half of the Gen X and baby boomer generations are behind.

If you have any questions about retirement or estate planning, please get in touch.

Weekly Focus – Think About It

“Wealth consists not in having great possessions, but in having few wants.”

―Epictetus, philosopher

Best regards,

Dennis Greensage

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/livecoverage/stock-market-today-053124/card/nasdaq-roars-in-late-trading-as-stocks-finish-strong-month-MvOOyCtoznraH3ttkx5m (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/06-03-24_Barrons_Nasdaq%20Rallies%20as%20Stocks%20Finish%20Strong%20Month_1.pdf)

https://www.barrons.com/articles/inflation-pce-fed-stocks-55fa0173?refsec=markets&mod=topics_markets (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/06-03-24_Barrons_Inflation%20Data%20Offer%20Good%20News%20for%20Stocks_2.pdf)

https://finance.yahoo.com/quote/%5EGSPC

https://www.conference-board.org/topics/consumer-confidence

https://www.reuters.com/markets/us/us-consumer-confidence-unexpectedly-improves-may-2024-05-28

https://www.bea.gov/sites/default/files/2024-05/pi0424.pdf

https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/06-03-24_Barrons_Data_7.pdf)

https://www.economist.com/finance-and-economics/2024/05/26/baby-boomers-are-loaded-why-are-they-so-stingy (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2024/06-03-24_The%20Economist_Baby%20Boomers%20are%20Loaded_9.pdf)

https://www.ebri.org/docs/default-source/rcs/2024-rcs/2024-rcs-release-report.pdf?sfvrsn=2447072f_1 [page 5]

https://finance.yahoo.com/news/20-cuts-social-security-may-123017196.html